Sometimes the best economists aren’t economists.

One of the most famous plays in Western history was penned by the German writer Johann Wolfgang von Goethe (1749-1832). His two-part drama, Faust, is considered one of the greatest works of German literature. This complicated and sometimes disturbing text tells the story of a young scholar, Faust, who enters into a pact with the devil, Mephistopheles. In return for Mephistopheles’ services to help him realize his ambitions, Faust wagers the devil his soul.

Throughout the play, Faust asks Mephistopheles to help him achieve several ostensibly good ends. But each time he summons up the devil’s power, Faust gets more than he bargains for. In one scene, for example, Faust finds himself living as the landlord of a prosperous estate. His tranquility is disturbed only by an elderly couple who holds a freehold enclave on Faust’s land. Faust asks Mephistopheles to displace them. The devil fulfills his request, but in a way unanticipated by Faust: the elderly couple’s house is incinerated and the couple murdered.

At the beginning of part two, however, the play makes a surprising excursion into economics. Accompanied by Mephistopheles, Faust attends the court of a ruler whose empire is facing financial ruin because of profligate government spending. Rather than urging the emperor to be more fiscally responsible, Mephistopheles — disguised, revealingly, as a court jester — suggests a different approach, one with disturbing parallels to our own age.

Noting that the empire’s currency is gold, Mephistopheles maintains there is surely plenty of undiscovered gold underneath the earth belonging to the emperor. Thus, he argues, the emperor can issue promissory notes for the value of this yet-to-be-found gold, thereby generating fresh monetary resources for the government and solving its debt problems.

Not surprisingly, the emperor and his treasurer are delighted with this idea. It means the monarch can avoid making hard economic choices while simultaneously providing the empire with desperately needed currency. Mephistopheles subsequently deluges the court with paper money, and Faust is praised by emperor and commoner alike.

The results, however, are not what are expected. First, the issuance of paper money does not solve the emperor’s spending problems. Instead the ruler and his court become even more extravagant, knowing they can always print more paper money to cover their ever-growing expenses. Second, the devil has subtly but fundamentally changed the basis of the empire’s currency. Instead of being rooted in the solidity offered by a tangible and valued asset, the currency is now based on flimsy paper promises. Thus long-term monetary stability and powerful restraints on extravagant government spending are sacrificed for short-term gain.

Goethe finished writing the second part of Faust in 1832. Modern economics was then only emerging from its infancy. Yet Goethe’s insights go to the heart of some of our most intractable long-term economic problems.

One concerns the impact of fiat money. Technically speaking, fiat money is a currency that a government declares to be legal tender, even though it has no intrinsic value. Throughout history, fiat money has been the exception rather than the rule. Most currencies have been based on physical commodities, particularly gold. By contrast fiat money is ultimately based upon enough people having faith that a given currency will be accepted for the purpose of economic transactions.

Such faith, however, is easily shaken. The euro’s recent tribulations are a good example of what happens when people begin losing their faith in a fiat currency. The expression “as good as gold” underscores the confidence people have always attached to commodity-backed currencies, especially in difficult economic times.

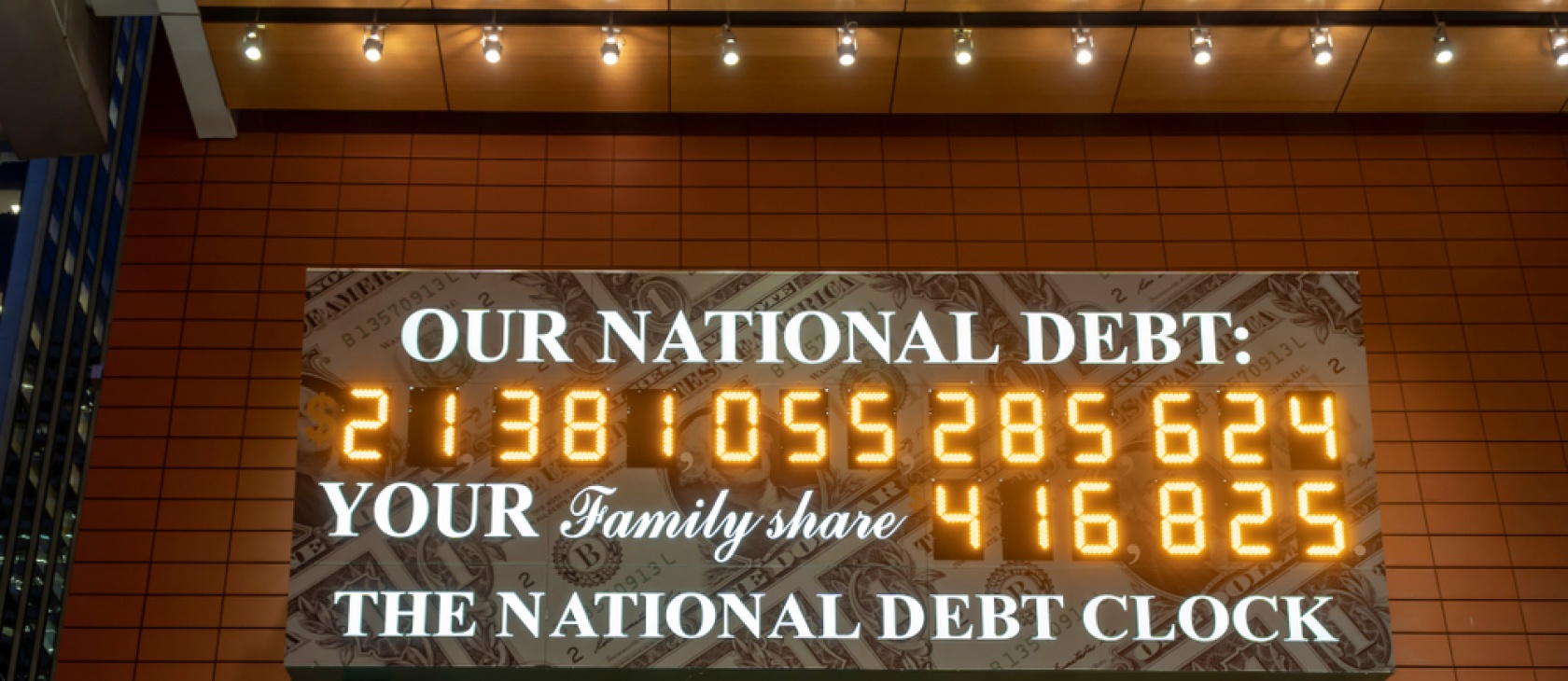

The second problem concerns the temptation faced by governments as they struggle to solve their deficit problems. In 2009, America’s federal government posted a $1.4 trillion deficit. That’s 10 percent of U.S gross domestic product (GDP), a level not witnessed since World War II. Given a choice between cutting spending, borrowing, or inflating the money supply, the third option appeals to many politicians. Moreover, like Goethe’s emperor, it’s exactly what many Western governments did between 1945 and 1980: short-term relief was bought at the expense of long-term fiscal stability.

But perhaps the biggest lesson from Goethe’s Faust is that self-deception is intrinsic to all foolish acts. Whenever governments choose comforting economic illusions over difficult economic truths, then, like Mephistopheles, they will employ dubious means such as state-engineered inflation or public-sector indebtedness to make ill-conceived economic policies seem less burdensome to those who will in the long term eventually have to pay the price.

There is, some might say, something demonic about that.