February 23, 1840, marked the birth of Carl Menger, a scholar who was to change economics forever. He founded what is now called the Austrian School. His crucial insight was to recognize that price is not based on what it costs to produce goods, as traditional economists had supposed, giving rise to the labour theory of value, on which the edifice of Marxism is built, but on what the demand is for them.

He had observed the difference between what classical economics taught and what actually happens in the real world. He pointed out that in real world transactions, people give up what they value less in order to gain what they value more. In other words, both gain from the exchange, and wealth is created because each participant gains something of more value than they had. The value of middlemen is that they facilitate such transactions. Instead of value deriving from the labour costs of production, as Smith and later Marx supposed, the value of labour derives from the value of the goods it produces.

Menger proposed that goods change hands, not because they are of equal value, but because people value them differently. Value does not reside in the object, deriving from its inputs, but resides instead in the mind of the observer, representing his or her subjective estimation of its worth.

This ‘subjective theory of value’ provoked a frenzied debate because it ran so counter to the prevailing economic view. It was so different from the German mainstream of thought that it was derisively dubbed “the Austrian School,” a name that later became a badge of honour, inspiring the work of subsequent scholars such as Ludwig von Mises and Friedrich Hayek.

Menger also took the view that money facilitated exchange by its role as a common medium, so the baker does not have to pay the cobbler in loaves for his shoes, but can use the convenient intermediary of money. Money developed naturally, like language.

Menger’s analysis acknowledges the way in which people behave in the real world, and that an economy is a process, not an object. It represents the ongoing reality of day-to-day transactions. It cannot be stopped to represent it in equations because its motion is a part of its essence.

It seems astonishing that someone born only three years after Queen Victoria came to the throne in Britain should be so modern in his insight and analysis, and it is a tribute to Menger that the school he founded should be so vibrant today. It is so because he looked at what actually happens, rather than at what theories tell us should happen.

This article originally appeared on the website of the Adam Smith Institute and is reprinted with permission.

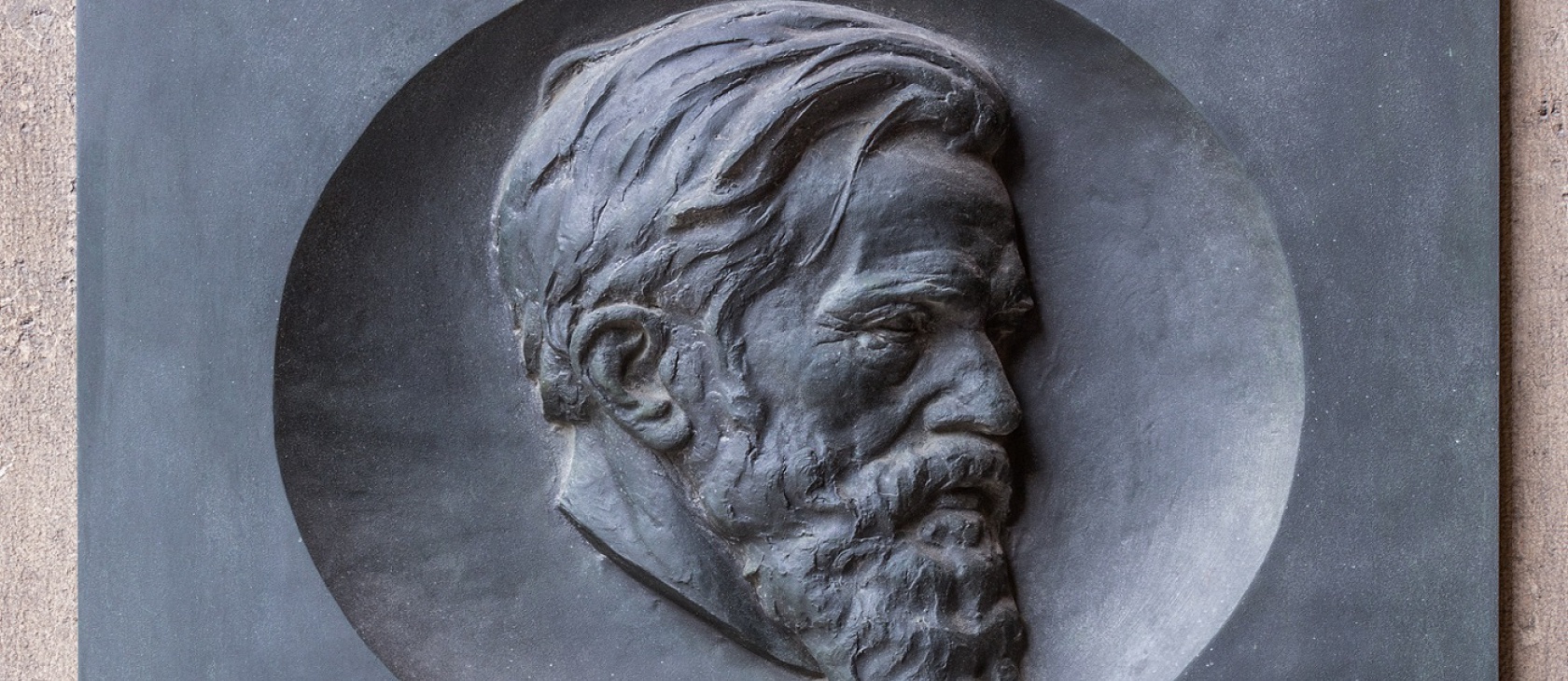

(Photo credit: Hubertl. This photo has been cropped and modified for size. CC BY-SA 4.0.)