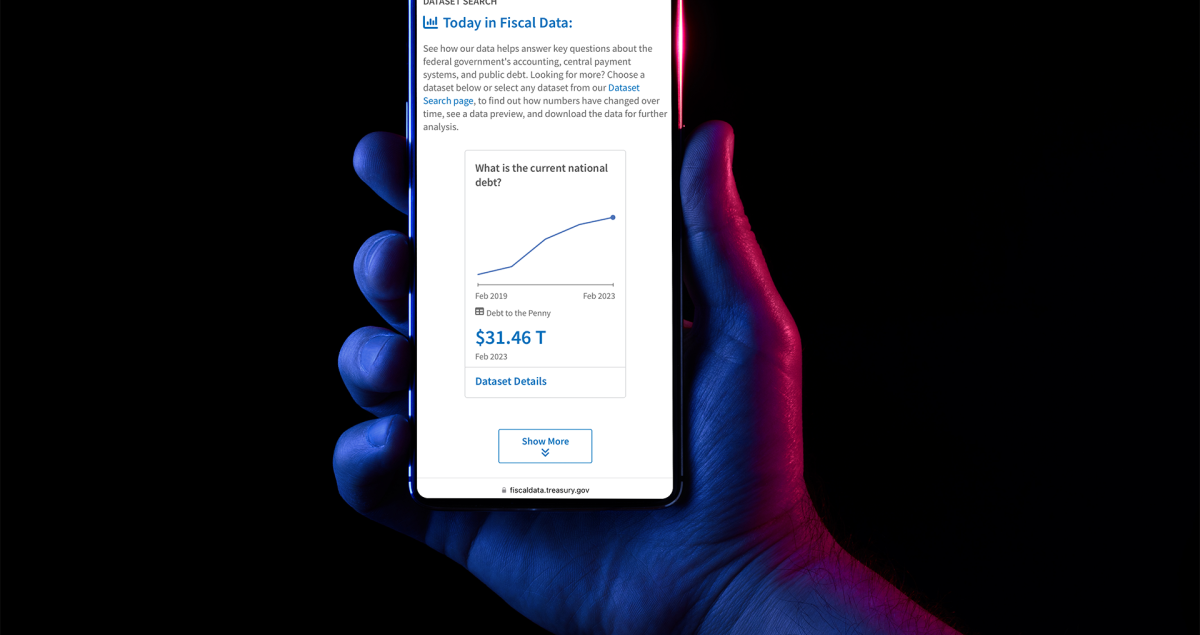

On the website of the U.S. Department of the Treasury, there is a section entitled “Debt to the Penny.” It reports the total debt of the U.S. government on a daily basis. Every so often it attracts some attention, invariably when the debt level passes some significant milestone.

We hear a lot about the national debt in figures that are unfathomable. But despite our “worry,” the American electorate seems unwilling to pressure their representatives in Congress to do much about it, fearing deep cuts in programs that even conservatives seek to preserve.

In February 2023, for example, America’s total public debt was more than $31 trillion. While this attracted some critical commentary, the topic quickly receded from public discussion. The reaction was similar when the national debt surged past the $20 trillion level back in September 2017. After considerable huffing and puffing about the event’s historic character alongside much lamenting about government fiscal irresponsibility, the attention of most commentators and Americans more generally wandered elsewhere.

This pattern indicates that, despite polling indicating that most Americans are worried about the size of the country’s public debt, it is not something that many Americans (let alone Congress) are anxious to tackle. That, I would suggest, tells us something about how America and the world has changed over the past 50 years, and in generally unhealthy ways.

A Useful Tool but Easily Abused

Public debt—or, more precisely, sovereign debt—is different from private debt. For one thing, sovereign states are not businesses. Unlike private companies and individuals, for example, the U.S. government has a monopoly of the money supply in America. It is thus in a position to alter the terms of America’s public debt in ways that private debtors cannot.

Economists have long argued about the economic effects of public debt. Back in 2010, the National Bureau of Economic Research published a paper suggesting that once a country’s public debt exceeds 90% of annual GDP, it tends to experience lower growth. This ignited ferocious arguments among economists. On one level, the debates concerned the linearity of the relationship between debt and growth, the merits of particular economic predictions based on extrapolations from existing empirical data, as well as arguments about the likely direction of government economic policy. The polemics also arose from long-standing divisions among economists and others concerning the efficacy of public borrowing and government intervention more generally.

The creation of a national public debt helped, after all, to establish America as a sovereign entity that united the fractious states more tightly in the 1790s.

Often missing from these types of discussions is attention to the historical dimension. The U.S. public debt has always played an oversize role in America’s history. The man who provided America with much of the financial architecture that it takes for granted today, Alexander Hamilton, famously described the establishment and successful management of a public debt in his 1790 First Report on Public Credit as a “national blessing.” According to Hamilton, creating a national debt was essential if America was to attract foreign capital and become a commercial republic. With this credit established, Hamilton maintained, many Americans and foreigners would invest in government securities. According to Hamilton, the consequent capital inflow would provide the fuel for a takeoff of the American economy.

At the same time, Hamilton considered instituting such a debt as key to forging unity among the hitherto disunited former British colonies. The creation of a national public debt helped, after all, to establish America as a sovereign entity that united the fractious states more tightly in the 1790s. Creating a national public debt also gave each state a common stake in the nation’s public finances. That was one reason Hamilton wanted the federal government to assume responsibility for the states’ Revolutionary War debts. He also saw implications for foreign policy. Britain’s rise to world-leader power status in the 18th century, Hamilton held, owed much to its ability to manage its public debt, a task that its major rival, France, had conspicuously failed to accomplish.

Hamilton’s plan had most of its anticipated economic effects. It helped, for instance, to establish America’s public credit at home and abroad, and thereby attracted capital to a country desperately needing it. The stabilization of the price of government securities, for example, meant that wealthy Americans who had been reluctant to invest started doing so. Above all, foreign capital started surging into the United States, aided by the fact that war had broken out in Europe.

Over the next 150 years, that public debt enabled America to do some spectacular things. These ranged from purchasing 828,000 square miles of territory from Napoleon’s France in 1803, to providing the financial muscle that helped the Allies crush Nazi Germany and Imperial Japan in World War II.

Yet America’s public debt was never envisaged as a means for papering over ad infinitum the fiscal gap that emerges when people want the federal government to expend immense sums regularly on various activities but don’t want their taxes raised to pay for such endeavors.

Key Founders certainly understood the folly of using public debt in such a manner. “There is not a more important and fundamental principle in legislation than that the ways and means ought always to face the public engagements; that our appropriations should ever go hand in hand with our promises.” James Madison spoke these words in a 1790 speech to Congress during contentious debates about whether the U.S. government should assume the states’ considerable debts. Madison was seeking to remind Americans that balanced budgets are a basic element of sound public finance, and that public debt was not supposed to be a way of ignoring the importance of this axiom.

Likewise, in the same report in which Hamilton advocated the establishment of a national debt, he insisted that he “ardently wishes to see it incorporated as a fundamental maxim in the system of public credit of the United States that the creation of debt should always be accompanied with the means of extinguishing it.” Furthermore, as noted by his most well-known biographer, Ron Chernow, Hamilton’s warnings about excessive public debt “vastly outnumber his paeans to public debt as a source of liquid capital.” In 1795, for instance, Hamilton described the progressive accumulation of debt as “perhaps the natural disease of all governments. And it is not easy to conceive anything more likely than this to lead to great and convulsive revolutions of Empire.”

At the time, Hamilton was undoubtedly thinking of France. Beginning in the late 17th century, France decisively displaced Spain as Europe’s most powerful country. France’s military and administrative modernization was not, however, matched by the same degree of fiscal modernization. Instead of updating its archaic fiscal and taxation systems, successive French kings used state debt to pay for wars in Europe and territorial expansion around the world in the 17th and 18th centuries. That included paying for France’s involvement in the American Revolutionary War. This turned out to be climacteric.

In short, serious mismanagement of the nation’s finances and the use of public debt to make up major shortfalls in income had brought the Bourbon monarchy to its knees. As Hamilton knew well, this had played a major role in the advent of the French Revolution. But as someone deeply read in history, Hamilton also surely had in mind how failure to control state debt had contributed to Imperial Spain’s decline as a world power and, even further back, the deterioration in Rome’s ability to govern its empire.

For the most part, a prudent approach to public debt generally prevailed throughout 19th-century America and well into the 20th century. Not coincidently, this was a time in which American presidents and legislators bragged about their successes at cutting state expenditures. The federal government regularly produced more annual surpluses than deficits. That helped keep the public debt quite low as a percentage of GDP.

Before 1980, Americans experienced only five comparatively brief periods of rising public debt levels. One was the result of Franklin Roosevelt’s effort to stimulate an ailing American economy via the New Deal. The other four occasions involved the financing of major military engagements such as the Civil War and World War II. In these cases, however, successful efforts were immediately made by presidents and Congress to get federal spending under control in order to reduce the public debt once the emergency had passed.

This pattern reflects a mindset about the national debt that viewed it as a way of financing the federal government’s efforts to address specific challenges as well as particular emergencies. It was never meant to become a type of permanent fiscal life support system for federal government spending. Alas, that is precisely what has happened to America.

A Different World

In the 1980s, America entered a different world insofar as its public debt was concerned. America’s public debt as a percentage of GDP started accelerating under Ronald Reagan and George H. W. Bush, underwent a slight decline under Bill Clinton, and then escalated again under George W. Bush, Barack Obama, Donald Trump, and Joe Biden.

Absent major fiscal reforms or a long economic boom, pressures to borrow even more will magnify as America’s population continues to age, its birth rate declines, and its Social Security and healthcare costs grow.

The reasons for this trend are not complicated. During these decades, government spending was not reduced in real terms and the American economy did not enjoy spectacular economic growth. The United States also engaged in a major military buildup in the 1980s, fought wars in Afghanistan and Iraq in the 1990s, 2000s, and 2010s. As if that were not enough, between 2008 and 2021, the federal government responded to a major financial crisis and a global pandemic by spending trillions of dollars.

We should keep in mind, however, that the key drivers of these expenditures that exceed income have been welfare programs rather than military and national defense spending. Something like 63% of the federal budget is allocated to mandatory spending, and this is overwhelmingly, as stated by the Center of Budget and Policy Priorities, on programs like “Social Security, Medicare, Medicaid, federal military and civilian retirement, veteran’s disability compensation, the Supplemental Nutrition Assistance Program [i.e., food stamps], and some farm price support programs.” Another 8% is spent on interest payments.

Taken together, these baked-in numbers translate into ongoing massive federal government expenditures that regularly exceed government income from taxation. The primary way in which the United States has made up the difference has been to borrow—big time. The biggest foreign holders of U.S. treasury securities in October 2022 were, in order, Japan, China, the United Kingdom, and Belgium. Intragovernmental debt is also owed by the Treasury to other U.S. government agencies, like the Social Security Fund. But the biggest holder of U.S. public debt is the Federal Reserve, American banks and investors, mutual funds, pensions funds, insurance companies, holders of savings bonds, as well as state and local governments.

Absent major fiscal reforms or a long economic boom, pressures to borrow even more will magnify as America’s population continues to age, its birth rate declines, and its Social Security and healthcare costs grow. In fact, America is already borrowing to make interest payments on the national debt. In July 2021, the Congressional Budget Office warned that America was on pace to see interest payments becoming the federal budget’s fastest-growing segment. Nor can we assume that interest rates will stay low. In fact, the more America borrows, the more likely it is that interest rates will increase.

Another problem is that if America’s national debt continues growing at its present pace, it will become a major drag on growth. Federal Reserve chairman Jerome Powell summarized the situation well when he told Congress in January 2022: “Debt is not at an unsustainable level, but the path is unsustainable—meaning it’s growing faster than the economy, meaningfully faster than the economy.” The growth of such debt is likely to increase the price of capital and thereby start crowding out private-sector investment in the economy, not to mention public-sector investment in activities such as national defense that are unquestionably the state’s responsibility.

America’s Struggle to Reduce Its Debt

All this points to a hard question with a disturbing answer. In the past, America was able to get its public debt back under control. Why do we struggle to do so today?

For all their government-skeptic rhetoric, Americans have become habituated to the state’s permanently undertaking many activities that go far beyond any reasonable conception of limited government.

One reason is that legislators, including many conservatives, have few incentives to do so. Diminishing the public debt today through real spending cuts would mean real reductions in ongoing big-ticket federal programs—income security, Social Security, Medicare, etc. Selling that to the millions of Americans—including many conservative Americans—who benefit from one or more of these outlays is politically very difficult. Americans may be willing to acknowledge America’s public debt as a problem in generic terms and say that something must be done in theory; but they are far less willing to entertain proposals for debt reduction that might impact programs that directly benefit themselves or those they know and love.

Indeed, even many self-described fiscal conservatives have proved unwilling to embrace real spending cuts as part of any effort to reduce public debt. It is not uncommon, for instance, for legislators to stress their efforts to cut the projected rate of increase in government spending. But that, to put it bluntly, is not a reduction in real spending. It is simply reducing the pace of increases in government expenditures.

Nor is it hard to find examples of American representatives and senators who denounce out-of-control spending and excessive public debt but don’t hesitate to lobby for subsidies for politically well-connected businesses located in their electorates. This isn’t surprising. If legislators believe their reelection depends upon their ability to deliver taxpayer dollars to their state or district, and if their electorates consider this part of their representatives’ job, we should not be shocked at their aversion to putting in place specific measures designed to diminish public debt.

From this standpoint, we start to see that, for all their government-skeptic rhetoric, Americans have become habituated to the state’s permanently undertaking many activities that go far beyond any reasonable conception of limited government. Even worse, Americans are reluctant to acknowledge the cost. Hence, America lacks a critical mass of citizens disposed to take the long-term view and support the hard decisions that would enable America to rein in its national debt and return that debt to the purposes for which it was intended. Any meaningful change requires enough Americans deciding that they really do want less government in their lives, and then acting accordingly.

All this analysis points to an unpalatable political fact. Unless enough citizens in a democracy are willing to support the difficult choices that enable nations to bring public debt under control, the chances that legislators and governments will do so is small.

Herein we confront a major political problem, one highlighted by the German economist Wilhelm Röpke, the intellectual architect of West Germany’s economic liberalization in 1948 and its subsequent rise to become Europe’s economic powerhouse. In a 1958 essay, Röpke observed that there is nothing in the welfare state’s basic conception to set internal limits on its growth. Moreover, if democracy degenerates into politicians competing for votes on the basis of who is considered better at delivering the most government-provided economic security for the most people, the welfare state’s continual increase is guaranteed, while the question of how to pay for it becomes a very secondary concern. In such circumstances, no one should be surprised that legislators revert to using public debt as a way of paying for expanding welfare programs without asking for tax increases.

A Question of Trust

At the foundation of the workability of public debt is a very basic principle: that creditors should and would receive what they were owed. If investors are confident that government securities will be repaid in full, then they will invest. Thus, what truly matters is trust that the government will make good on its repayments. As Hamilton put it, “Opinion is the soul of it.”

Such confidence is only a question of investors calculating that the United States is very likely to meet its debt obligations. At the heart of its ability to do this, and therefore successfully maintain America’s national debt, is the issue of trust and the willingness to fulfill certain moral commitments. As Hamilton wrote, “considerations of still greater authority” applicable to sovereign debt questions are directly derived from what Hamilton called “immutable principles of moral obligation”—in short, a willingness to fulfill promises.

If there is anything that needs to be injected into our contemporary discussion of national debt, it is precisely the language of responsibility and obligation. One thing that financial history certainly teaches us is that many governments have, at best, mixed track records regarding their willingness to meet the obligations that underpin national debt. Over 200 years ago, Adam Smith noted in his Wealth of Nations that

when national debts have once been accumulated to a certain degree, there is scarce … a single instance of their having been fairly and completely paid. The liberation of the public revenue, if it has ever been brought about at all, has always been brought about by a bankruptcy: sometimes by an avowed one, but always by a real one, though frequently by a pretended payment.

Among other things, Smith was thinking here of currency devaluations. These, he maintained, benefited “the idle and profuse debtor at the expense of the industrious and frugal creditor.” While the original promise’s formal structure was maintained, governments used their power over the money supply to unilaterally alter the terms of agreements with creditors.

This isn’t a peculiarly modern insight. Reacting to the habit of medieval monarchs debasing their currencies to reduce state debt, the French bishop and theologian Nicole Oresme of Lisieux claimed in his Tractatus de origine, natura, iure et mutationibus monetarum (1355) that such debasements were usually unjust because they allowed governments to avoid paying what they really owed. Echoing these concerns two centuries later, the Spanish Jesuit Juan de Mariana observed that many governments resorted to currency debasements to avoid making the cuts in public expenditure often needed to get public debt under control.

In our time, we have seen sovereign debt faults in countries ranging from Argentina (2001) and Venezuela (2017) to Russia (2020), Lebanon (2020), and Zambia (2020). The economic damage was considerable and regrettable in the case of the citizens of these countries. The other form of damage was reputational. This, however, is appropriate because gross violations of trust merit such a response. It also reaffirms the principle that promises should, all other things being equal, be kept, regardless of whether the debtor is a government, a business, or an individual.

This does not mean that governments should routinely sacrifice societies on the altar of debt repayment. It does mean, however, that Americans need to think far more seriously about the moral and legal obligations that underpin public debt.

Politics, it is often said, is the art of the possible. This is certainly true. But thinking about the possible is not a blank check for American legislators and citizens to ignore the challenges associated with the growth in America’s public debt. Yes, addressing these questions is difficult. Nevertheless, as Hamilton’s greatest political opponent, Thomas Jefferson, insisted: “We must not let our rulers load us with perpetual debt. We must make our election between economy and liberty, or profusion and servitude.”

Unless we understand the need to be clear-eyed about America’s national debt and its present dysfunctionalities, I am confident that Americans will be revisiting this conversation in a few years’ time when America’s national debt hits the $40 trillion mark. That will be as much a sign of deep inertia in the American body politic as it will be an indication of fiscal apathy and negligence. And we will have only ourselves to blame.