This is the fifth installment of the "Romenomics” series, which aims to study commerce in ancient Rome in order to better appreciate the economic present. See part one, part two, part three, and part four of the series. - Ed.

Anyone who thinks it is easy to understand price trends over a millennium and billions of transactions in ancient Rome has a lot of reading to do, starting with this 300-page study. In a way, it is impossible, as in any market study over such an extended period and with very little written testimony. Nonetheless, not everything boils down to conjecture.

No doubt, Roman prices fluctuated in the short-term and rose over the long-term; there were severe crashes followed by recoveries; above all, prices acted as “signals” for several factors: overall demand, overall supply, personal preferences, as well as economic interventionism with state-mandated controls, price ceilings, subsidies, and even currency devaluation.

In general, pricing in the laissez-faire Roman Empire was determined by the natural laws of markets in which consumers would offer what they believed was a fair exchange for the product or service they received from vendors.

A good sector to focus on and with greater certainty for establishing price points was grain, the very staple of the Roman diet. As we learn from Roman scholar, Doug Smith:

The average Roman adult male ate two pounds of wheat bread each day. While loaves of baked bread were available in the market, most evidence on prices that have come down to us refer to the standard measure for wheat, the modius (about two gallons). A modius would bake up into roughly 20 one pound loaves of bread … By the time of Caesar [one modius] was 12 asses; under Nero it could be as much as 2 denarii (32 asses). These prices are really rather stable when compared to the inflation that the modern world…[until] wars [and other crises] of the third century resulted in an end of this stability, frequently raising prices to levels where ordinary workers were reduced to near subsistence levels.

Hence, if a couple of buckets of grain increased beyond average purchasing power levels, especially for the lower plebeian classes, then raised prices were often related to greater scarcity (while demand remained the same) following episodes of pestilence, drought, poor soil management, and even shipwrecks of thousands of tons of grain exported from northern Africa, Rome's "breadbasket."

Decreased market price trends, on the other hand, didn't follow the same "natural laws" of markets. Rome didn't really develop cheaper products alongside technology improvements at the same industrial pace we experience today. Prices frequently dropped when Rome’s emperors would place ceilings on wheat and corn rates, or when they subsidized bulk acquisitions to distribute via the famous grain doles (cura Annonae) to about one-fifth of the capital’s population, sometimes at greatly reduced costs but most often gratis. At the very least, according to Smith, political leaders believed that by “ensuring the availability of grain in the market, even to the point of buying high priced grain and reselling it at a loss [they could protect] a public service,” especially to evade political backlash or dangerous popular uprisings.

Photo credit Wikicommons: CC BY-SA 3.0 and Wolfgang Rieger

Grain price caps were enforced at various points in Roman history. Most famously, this occurred during a period of hyperinflation, war, and political crisis during the third and fourth centuries. Emperors, through their tribunes, began purchasing thousands of tons of grain and reselling them at low fixed rates to supplement the bread doles. This strategy was actually first introduced by the Caius Gracchus in the Republican era via the Lex Sempronia Frumentaria, “which allowed every Roman citizen the right to buy a certain amount of wheat at an official price much lower than the market price.” Furthermore, according to the Mises Institute, in 58 B.C. the law was "improved," but there were unintended consequences "[that] came as a surprise to the government. Most of the farmers remaining in the countryside simply left to live in Rome without working.” While this was an enormous burden on Rome’s coffers and disincentivized farmers, top political leaders believed they retained soft despotic rule over Roman citizens who had grown dependent on the welfare state.

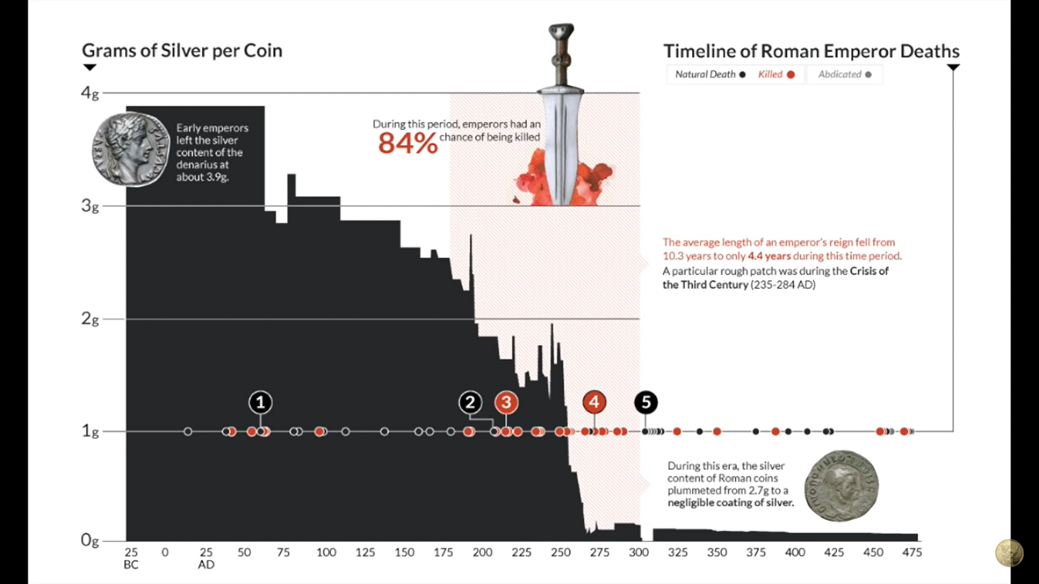

While Keynesian-style subsidies definitely affected the cost of certain staples like grain, and even the labor that went into producing them, what was more devastating was inflation. Its root cause in ancient Rome was due to sporadic currency devaluation. Specifically, it was the debasement of silver coinage (denarius and later the antoninianus).

In the early Roman Empire, a denarius weighed roughly four grams and had between 90-95% purity of silver. Nero was the first emperor to debase the denarius which, in the first century A.D., was worth a day’s wages for skilled labor. In order to finance reconstruction after the Great Fire of Rome (64 A.D.), especially for his lavish new imperial palace (the Domus Aurea or "Golden House"), Nero debased its silver content to 3.3 grams, thus causing the denarius to lose about 20% of its previous value. Hence, Nero could mint 20% more denarii while retaining the same face value. Naturally, with this fiat money, inflation rose by the same percentage, while Nero took the easy route to finance ambitious public expenditures. At this point, inflation and later hyperinflation, was firmly set into motion in the Roman economy until its eventual fall in the late fifth century.

YouTube screenshot: https://www.youtube.com/watch?v=-xQiXCkedgU

As mints entered ever more worthless coins into circulation to pay government officials, state projects, and soldiers, the payees immediately understood the greatly diminished value of the denarius and antoninianus coins, because they were noticeably lighter and could even be controlled by a system of counterweights. According to DailyHistory, it was “estimated that the inflation rate reached an astronomical rate of 15,000% between AD 200 and 300. In terms of a tangible example, one Roman pound of gold was valued at 72,000 denarii in AD 301, which would be nearly impossible for any Roman to have that many coins on his or her person.”

Since inflation skyrocketed throughout a turbulent third century and the start of the fourth century - after a series of coups, assassinations, and eventual conversion of the empire into a tetrarchy - Diocletian issued the Edict of Maximum Prices in 301 to stave off economic catastrophe. However, we read, his edict “drove consumers to the black market, [and] the prices continued to soar ... Suffering from myopia and a lack of understanding of economics, Diocletian’s successors, for the most part, were also unable to stem the tide of inflation and in fact kept many of his policies, including price controls.”

It is thought-provoking reading about just how badly prices got out of control in the decades running up to the fall of Rome in 476 A.D., very similar to what we saw in post-World War I Germany and in today's Venezuela. For example:

A measure of wheat in Roman Egypt that sold for six drachmas in the first century AD increased to 200 drachmas by AD 276. Egyptian wheat sold for 78,000 drachmas in AD 324 and over 2 million drachmas by AD 334.

Some scholars note that economic chaos was such that citizens hoped they would be captured by "better-off barbarians" and even actively moved outside the Roman Empire in search of new opportunities. As Jean-Philippe Levy notes:

State intervention and a crushing fiscal policy made the whole empire groan under the yoke; more than once, both poor men and rich prayed that the barbarians would deliver them from it. In A.D. 378, the Balkan miners went over en masse to the Visigoth invaders, and just prior to A.D. 500 the priest Salvian expressed the universal resignation to barbarian domination.

There was even a great movement back to bartering, thereby reducing much of Rome to the primitive trade when it was a mere swampy village. People stopped saving and began hoarding purer forms of precious metals. Who would hold on to their bags of denarii and antoniniani if, in a year or so, they would lose another major part of their inherent value after further debasement? Sound familiar? Carpe diem!

What we learn from the Romans is that any state intervention into price controls and fiat monetary policy creates false economies or at least false hopes for stable, "fixed" prices. Together they foment a precipitous spiral of no-return. Indeed, many scholars list the unstoppable hyperinflation as one of the top economic causes of Rome's fall. The concept of living within one’s means was nonsensical to the vainglorious Roman Empire that put on a financial façade of good economic health to justify funding endless wars and to maintain its status as the world's eternal geopolitical superpower.