In June 2019, Democratic presidential candidate and current Vermont Senator Bernie Sanders introduced a plan for eliminating $1.6 trillion dollars in student loans currently held by about 45 million Americans. This was more radical even than a similarly ambitious plan presented by his Democratic rival and Senate colleague Elizabeth Warren. With the election cycle for 2020 looming in the near future, this is one of several issues that will remain at the forefront of the discussion. This is especially true as candidates attempt to appeal to younger Americans, who are more likely to be impacted by the burden of student loan debt and who stand to benefit from such a plan.

But even with the debt burden being so great, and resting on the shoulders of so many Americans, is forgiveness of these loans the best path forward? Or does the system need a more fundamental overhaul?

Federal student aid comes in a few basic forms. Direct aid comes in the form of grants and loans. There are also select programs that allow for loan forgiveness for engaging in certain professions. It was not until 2013 that more than 50 percent of all undergraduate students received some sort of federal aid and, since that point, the numbers have only continued to rise. The stated purpose of federal aid is to provide access to higher education to those who would otherwise be unable to afford it, most likely someone who would be a first-generation college attendee. Those who borrow to pay tuition are doing so with the expectation of high-paying jobs that will enable the loans to be repaid quickly. But as far back as 1976 the Federal Trade Commission, a government agency that was investigating how institutions benefit from aid programs, found the prospects of these programs effectively helping this demographic to be remote. The FTC reported:

This type of [potential student] just does not have an independent standard or guidance by which to measure vague and seductive claims about better jobs and high salaries … [S]uch an individual is particularly susceptible to a salesperson with a polished sales presentation who shows how the government will assist the consumer attending school and begin the road to success.

In the years since this report, it has become clear that the complex system of federally sourced student aid has produced some unintended consequences. The institutions that receive federal aid must comply with certain regulations, but once the aid arrives and is applied to a student’s account, the income is just like any other income. The regulations on the front end result in revenue that is easy to secure at the risk of the student. It is no surprise then to find that one of the regulations for schools that are eligible to accept federal aid is that only a portion of the total revenue can be from that source, thereby curbing the development of diploma mills set up with the exclusive purpose of receiving government aid for student expenses. The problem, however, is that the percentage of non-government aid required has shrunk to just 10 percent, meaning that 90 percent of revenue can be through federal aid programs. The remaining 10 percent, however, need not be from private sources, because there are myriad government aid programs that do not count in that 90 percent tally.

One underlying question in this debate is, “What is the value of higher education?” Unfortunately, this is not an easily answerable question. The low interest, easily secured loans and grants have distorted the market. Many who would never have considered a college education have gone this route and amassed debt in the process. This market interference makes it nearly impossible to calculate the point of equilibrium in the market for education. In the process of making education more accessible, educational credentials have become diluted. Where a college degree in a previous generation may have signaled certain things to prospective employers, those signals are now weakened because the field is full of unnecessary degrees that were relatively easy to attain, both financially and in terms of the opportunity cost associated with time investment in the process.

Should education be off limits to some? The answer depends on how the context of this question is framed. Education, like every other good, has a point of market equilibrium, and any scheme to subsidize it will distort the market. Each consumer should decide – just like with bananas, cars, houses, and vacations – whether a good has more value to him or her than the costs in terms of financial resources and time associated with obtaining it.

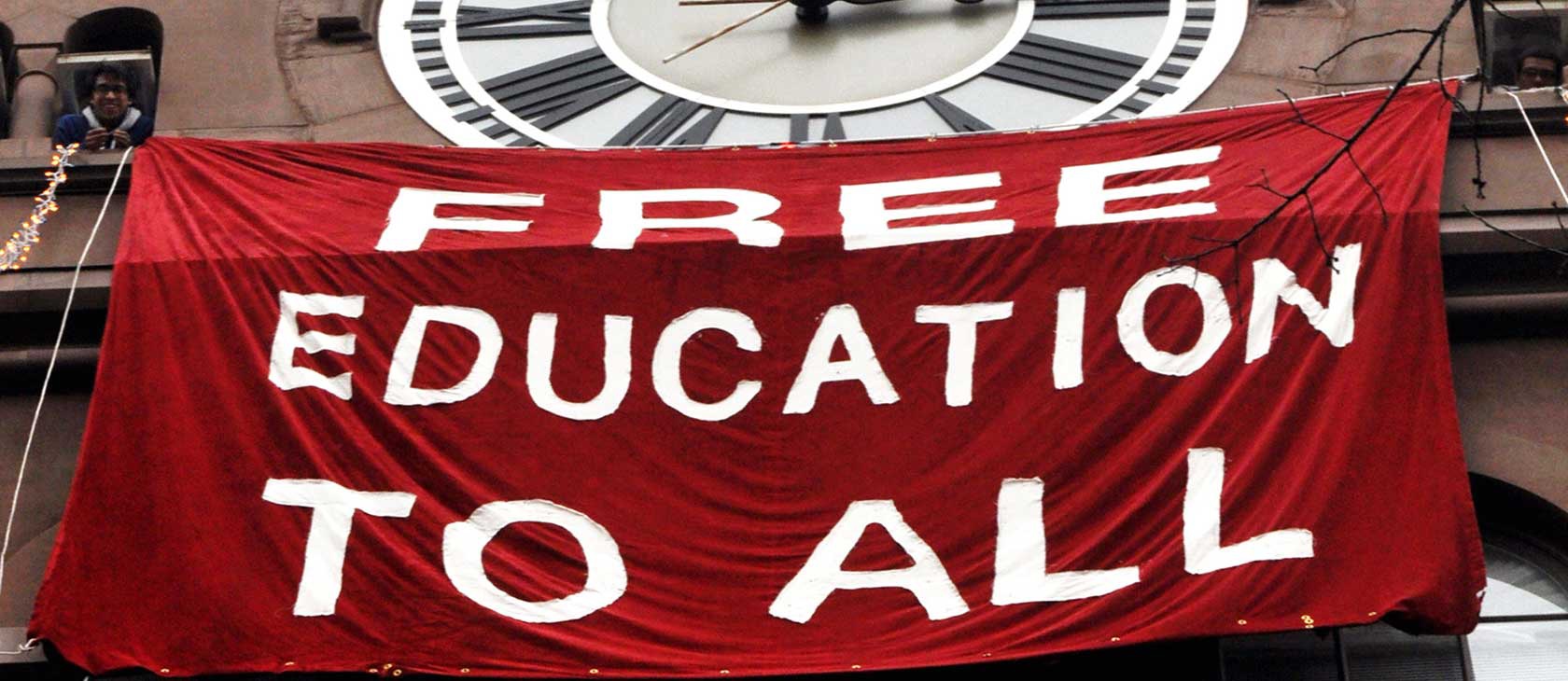

The current crisis involves the confluence of ballooning debt and college expense, devalued credentials resulting in unemployment and underemployment, and the birth of cottage industries designed to capitalize on the government-designed funding schemes. It will be impossible to repair all of these with forgiven loans and free education. Moral hazard compounded with more moral hazard will only produce more of the same problems and create others that are yet unforeseen. The solution for the current lot of Americans holding significant student loan debt might not be readily apparent, but let’s not replicate these problems in another generation by perpetuating the same programs and policies that have produced the current situation.

Photo license: (CC BY-SA 2.0).