OMAHA – Wandering exhibit halls at the Berkshire Hathaway annual meeting, Linda Bi fixed her gaze on a row of red Tony Lama cowboy boots. She tried on three pair before buying a $130 set of knee-high boots.

Bi, president of Chicago Expert Importers, took over her family’s auto parts import business when her husband died of a stroke in 2000. She says she has since grown revenues from $6 million to $35 million per year, importing parts made of steel and aluminum from China, and selling them to U.S. auto suppliers. “Mostly, we grew our business through a good reputation with clients,” she said.

She acknowledges the tariffs President Trump has proposed directly affect her products. “It makes me nervous,” she said, posing next to a cardboard cutout of Warren Buffett at the Precision Castparts booth during the lunch break of the Saturday Berkshire Hathaway annual meeting. She came to Omaha to get away from politics, to hear from “big, deep thinkers,” she said. Bi and thousands of other Chinese visitors are increasingly showing up at the Berkshire annual meeting, which is sometimes called the “Woodstock of Capitalism” or the “Church of Warren Buffett.”

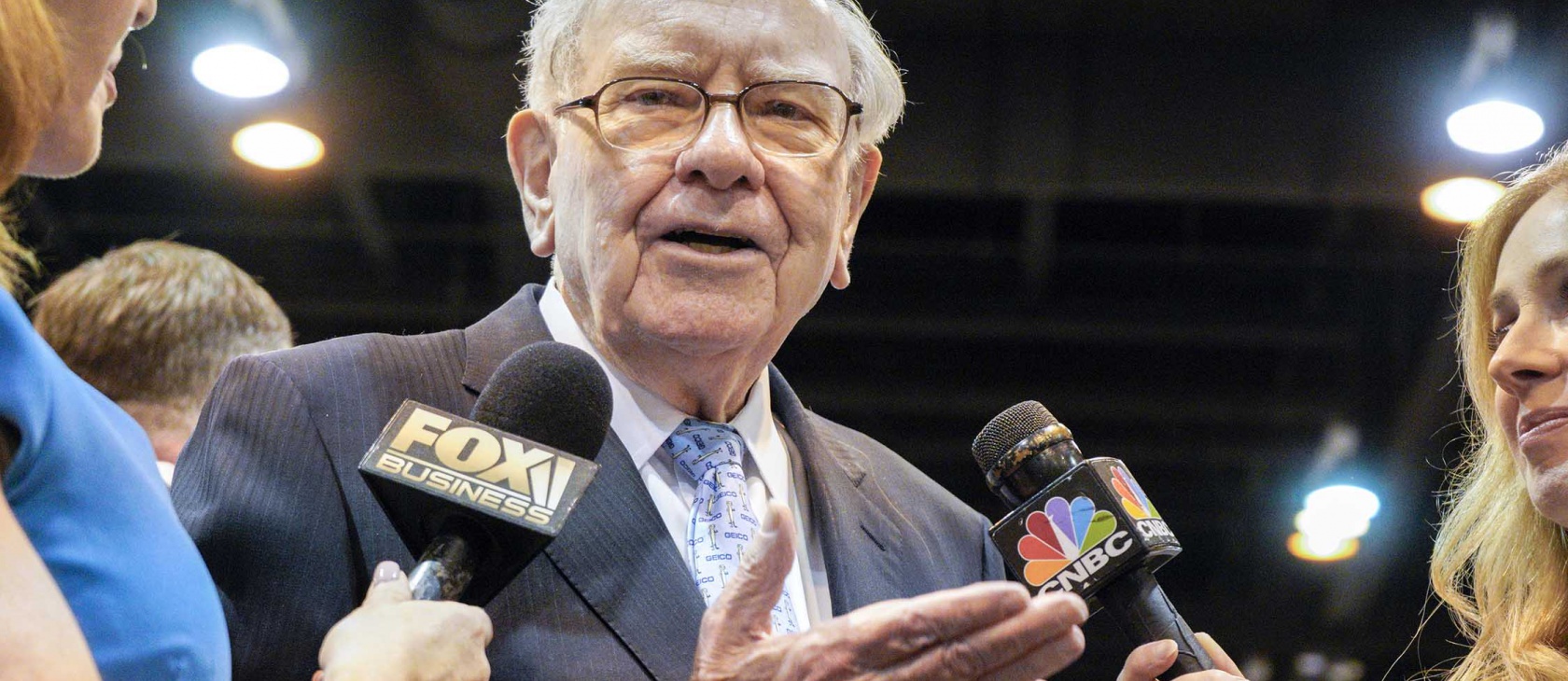

Roughly 42,000 citizens and investors worldwide descend on Omaha, Neb., for one weekend every May to hear the homespun wisdom and gospel of wealth from 87-year-old billionaire and legendary investor Warren Buffett and his sidekick, 94-year-old Charlie Munger. As many as 5,000 Chinese Americans and mainland Chinese attended this past May. While corporate annual meetings are normally boring affairs, Buffett and Munger, have turned theirs into a festival of creativity that include ad agency quality videos, Saturday Night Live style skits and one-line zingers such as Munger calling cryptocurrencies "turds."

Berkshire rookie

As a Berkshire shareholder for a decade, I wanted to attend the spectacle, particularly while Buffett and Munger are alive. Berkshire represents, to me, many positive elements in American capitalism: executive accountability to answer questions from shareholders; people seeking to understand the investments they own; an optimistic view of free market enterprise and its potential to create wealth for investors, employment for workers and growth for an economy.

At my daughter’s birthday party on Long Island in February, my neighbor Ming Zhong told me he attends the Berkshire meeting every year and started a side conference in Chinese and English. He invited me to attend. I accepted and said I’d like to write about the event and would cover my own expenses including the overpriced airline flight (I spent $800 on a ticket from New York to Omaha) and hotel (I spent more than $1,000 for three nights). Thus began my long weekend journey to Omaha for 72 hours, embedded with the Chinese at the church of Berkshire.

Berkshire represents, to me, many positive elements in American capitalism: executive accountability...an optimistic view of free market enterprise...employment for workers and growth for an economy.

Chinese delegations host their own investment conferences the day before the Berkshire shareholder meeting. The Sino-American Venture Capital Summit drew hundreds of Chinese attendees this year at the Hilton hotel downtown. New York firm Pinebase Capital hosted an “Omaha Investment Forum” that drew hundreds more. Chinese tech company Tencent and Aegon-Industrial Fund hosted an event after the Berkshire meeting on Saturday. The conference I attended was called the “Omaha Dialogue” or “Omaha Summit” at the DoubleTree Hilton downtown, inviting Chinese students and business leaders alike from Mainland China and the United States to discuss topics such as “Buffett’s Wisdom and Inspiration.” The Summit has featured Nobel Prize winning economist Robert Shiller, Nebraska Gov. Pete Rickets and Wall Street veteran Harry Edelson.

These events function as a home for Chinese who want to latch on to the Buffett magic. Instead of just wandering the streets and halls in Omaha, perhaps feeling like foreigners amid a sea of Americana capitalism, these seminars offer a guided tour of the Berkshire meeting and provide a sense of community to Chinese visitors. They also provide a way to engage Chinese youth into investing, with sons and daughters of some wealthy and notable Chinese families attending.

Thursday afternoon

Arriving two days ahead of the annual meeting, I was chatting with some attendees at the Doubletree about what drives the Chinese interest in Buffett before Zhenglin Wei, a counselor to the Chinese Embassy in Washington, appeared in a fitted, dark suit and metal-framed glasses. With gel-slicked hair, Wei started championing the U.S. and China trade relationship and attacking President Donald Trump’s recent trade actions.

“China and America should have mutual respect to understand each other and have mutual dialogue,” he said. “China wants continue to reform and continue ways to open up.” Chinese visitors in the room listened respectfully. The Americans in the room asked pointed questions, making Wei visibly sweat.

As more people showed up, we headed over to Gorat’s, the favorite steakhouse of Buffett that started in the 1940s. At Gorat’s, a world map in the foyer featured stickpins piercing the countries where visitors are from. Some in our entourage were proud that China had dozens of stickpins, second only to the United States on the map. We dined on T-bone steaks and root beer floats – a first for many of the Chinese -- before shuttling back to the hotel.

Friday

In the early afternoon, the Omaha Dialogue kicked off with layers of welcomes from local politicians, event sponsors and a woman named Kelly Cha, who once sang “I’ve Been Working on the Railroad” along with Warren Buffett while he played the ukulele in China. Then counselor Wei took the microphone and started to wax political on the looming trade war.

“America has a lot of strength and power. I admire America. I admit there is still distance between China and America,” he said before rattling off some stats about the importance of trade with China for Nebraska and the United States. “The good relationship between the U.S. and China is not just about trade for each country but the stability of the world.”

Then a series of sessions analyzed the genius of Buffett in light of current investing questions. Some panelists discussed Buffett as a philanthropist and asked if wealthy Chinese would give their money away as Buffett has pledged. They bantered about why Buffett bought a large stake in computer giant Apple Inc., when the stock is at all-time highs. That’s an investment move that breaks with Buffett’s normal strategy of value investing, which dictates buying stock at a temporary low and aiming to own those assets for a long time, possibly for life. They kibitzed about what Buffett might do next with the more than $100 billion in cash on Berkshire’s balance sheet. Acquisitions? Will he make some in China? Will he buy shares in the troubled General Electric?

Before dinner, Feng Han one co-founder of the Chinese blockchain company sponsoring the event, Elastos, made a presentation about how Elastos plans to create a new decentralized Internet. “Today, we have a poor Internet,” he said. “It’s like North Korea.” It sounded like a script for the HBO show Silicon Valley (the main character on the show, Richard Hendricks, concocts a similar decentralized “new” internet). One Chinese man from Beijing got up to recite a very earnest poem about the company, Elastos. Most of the audience, bored by now, were entranced by their mobile phones, tap-tap-tapping away inside WeChat, a blockbuster messaging app from China.

The next thing I knew, someone handed me a microphone and asked me to sing lead on, “I’ve been working on the railroad.” Perplexed, I ambled on stage and stood next to Linda Bi and Elastos company co-founder, Rong Chen and others in our makeshift chorus. They called up lyrics on their phones. They seemed to think it is an important song, perhaps because Buffett owns Burlington Northern Santa Fe railroad? I’m not sure they realized it’s a folk song and kids song. Nevertheless we sang the song in an awkward, low key. Despite a mediocre performance, we celebrated with high fives.

As the dinner wound down, I asked one attendee named John Li if he wanted to stop by a cocktail reception hosted by Whitney Tilson, a New York investor and expert on Berkshire. Li sent his assistant, Yuan, to the parking garage to retrieve their black Dodge minivan. We zip over to the Hilton 5 blocks away. As we walk into the lobby, we see hundreds of Chinese milling about at the Sino-American VC conference. We press on, finding the Tilson reception around the corner where a blond woman sits at a registration table with a bowl of gourmet fortune cookies. Inside are sayings by Charlie Munger. I open mine. It says, “The best armor of old age is a well spent life preceding it.”

Tilson has attended 21 Berkshire annual meetings, a designation that gives him seniority status in this cult. In the early days, before the Berkshire meetings were livecast, he took copious notes and helped compile aphorisms of Buffett and Munger. Tilson says their wisdom has influenced his life in finance but also in marriage and fatherhood.

He hit a lot of notes that make value investors zone in like parishioners at a church, the high church of Warren Buffett.

We met a German guy on our way in and ordered a mixed drink called a “Warren” (a Cherry Coke with Rum). Tilson, in the corner of the room, was holding court, wearing brown dress shoes, black jeans, a sport coat and patterned shirt. He dinged his glass to get people’s attention, hopped up on a hotel chair and started telling his story and explaining his new educational venture. He told how he grew $1 million to $200 million and then saw it slide back to $50 million during his 20 years running a boutique hedge fund.

“I started doing stuff I shouldn’t have been doing. But it worked initially,” he said. “That’s really dangerous. It draws you in.” He warned investors not to get into fads like bitcoin. He hit a lot of notes that make value investors zone in like parishioners at a church, the high church of Warren Buffett.

As I surveyed the room, I saw peoples’ faces reveal a joy in camaraderie - the community they find here among others with a shared ardor for Berkshire, for Munger, Buffett and their approach to investing and life. Their devotion is intellectual, filial and almost religious in nature.

Tilson waxed on soapbox-style for nearly 10 minutes before stepping down. Mingling around, I join a conversation with a dad from Philly, a librarian who has attended four Berkshire meetings, bringing his 14-year-old, hoodie-wearing son for the first time. I ask if he agrees the Buffett faithful resemble a church, a body of devotees and a shared philosophy. He thinks about it and says, “That’s true, except that the philosophy here can be measured. It can be measured by the performance of shares and all the financial data points and metrics we use to talk about the company’s performance.”

We chat a bit more and then say goodbye. I walk back to the Doubletree. The streets of Omaha are largely empty. A few loud pickup trucks and Ford mustangs rumble past with hillbilly mufflers roaring. The 42,000 Berkshire fans are either networking indoors or asleep, prepping for the big annual meeting the coming morning. Some of them wake up as early as 1 a.m. to wait in line for a good seat on the floor of the Omaha CenturyLink Center arena. Unsurprisingly, hundreds of these early bird tail-gaiters are Chinese students.

Saturday morning

On the elevator down, I see a bald man with a shareholder tag and his 10-year-old daughter with him, both wearing lanyards around their necks that say, “Shareholder.”

“Starting them young?” I say?

“Yes. It’s her first time. My 21st time.”

I tell him that I should bring my daughter sometime, who is 6-years-old. He excitedly tells me that I should have my kids start watching the cartoon about Buffett, “Secret Millionaire’s Club.”

In front of the DoubleTree, I wait for the shuttle bus over to CenturyLink. A guy in shorts with slicked white hair and a cigarette dangling from his lips says, “where ya from?” When I tell him him New York, he asks if Manhattan or elsewhere.

“I go to Saratoga every year,” he says.

Horse Racing?

“Yeah. That’s why I am here too.”

Oh? Is there a race today?

“No. It’s legal here so I am betting on horses from downtown.”

My shuttle arrives so we don’t finish the conversation. But it is clear not all visitors to Omaha this weekend are Buffett style value investors. Some are straight-up gamblers.

The Buffett show

As I walked into CenturyLink, a modified version of the Jay-Z and Alicia Keys’ ode to Gotham blasted over loudspeakers. Instead of the words “New York,” visitors hear substitute lyrics such as, “Our team will make you feel brand new; Our work will inspire you. Let’s hear it for Berk-shire, Berk-shire, Berk-shire.” It turns out Jay-Z and Buffett are friends.

Roughly 20,000 people are wearing credentials that say “Shareholder,” crammed into the arena with up to 22,000 more watching from overflow rooms in Omaha. Millions more watch the live stream on Yahoo Finance that goes out in English and Mandarin. Some Fortune 500 companies such as U.S. Steel have annual meetings that fulfill the letter of the law, take place in a small room with 50 or fewer people attending and last an hour or less. Buffett, on the other hand, believes an annual meeting of shareholders is to be a celebration and a forum for lengthy questions and answers. He also thinks an annual meeting is supposed to be fun.

Before Buffett and Munger came on stage, a lengthy video featured advertisements for Berkshire products such as Dairy Queen, Fruit of the Loom and Coca-Cola interspersed between spoof videos featuring Buffett. One video showed Buffett playing basketball against NBA star LeBron James and entering a boxing ring unleashing a bleeped-out tirade against world champion boxer Floyd Mayweather. Turns out both those athletes are chummy with Buffett.

Another video featured singer Katy Perry talking about her famous viral "left shark" Super Bowl dancer, admitting to the crowd that the left shark was, in fact, Warren Buffett and the right shark was Charlie Munger. The crowd roared in laughter and applause. How did this happen? Katy Perry has sought out Buffett for friendship and advice.

The crowd was warmed up for one of the most unique five-hour conversations on planet earth.

When Buffett and Munger strolled to their plain chairs on stage at a plain navy table, the audience was ready for the unpretentious rock stars of the investing world. Buffett reported the company’s quarterly earnings and opened the morning with a story. His slides overhead showed the front page of The New York Times on March 9, 1942, as the United States was three months into World War II and the world was in an uncertain place. “We were in big trouble in the Pacific,” Buffett said. “It was only going to be a couple months later before the Philippines fell.”

He talked about buying his first stock in City Service Preferred that week after analysis with his father. He lost $3 on that in one day. But he put up another slide that showed he had bought at a low and the price eventually went to $200. Young Warren had sold at $40 a share and made $5.25. The lesson?

“Things were looking bad in the Pacific and Atlantic theater,” he said. “But everybody knew America was going to win the war. The American system had been working well since 1776.”

He then explained that an investment of $10,000 in gold in 1942 would have purchased 300 ounces of gold and would be worth $400,000 today, a paltry sum compared to the same amount invested in the stock market, which would be worth $51 million now. As his sidekick Charlie crunched away on peanut brittle, looking bored, Buffett delivered the optimistic hammer blow to the audience: “It is remarkable to me that we have operated in this country with the greatest tailwind in our back,” Buffett said. “What counts is having a philosophy you stick with.”

He told investors that as they listen to the questions and answers to come, they should consider an overriding question: “How will American business do during the course of your lifetime?” He was challenging critics and doubters, arguing that market-based capitalism was the greatest driver of progress in the world.

By then, the crowd was warmed up for one of the most unique five-hour conversations on planet earth: Thousands of people having a serious, reverent, insightful and often humorous conversation with two wise, wealthy, older men who are happy to share their wisdom about finance and life with their shareholders whom they refer to as “partners.”

Omaha as Delphi

In ancient Greece, the mountainside city of Delphi was deemed the belly button of the world, a religious place where city states like Athens and Corinth erected temples to Greek gods. People made pilgrimages to Delphi to hear wisdom from the “Oracle,” a prophetess.

Buffett is sometimes called “The Oracle of Omaha” and the city of Omaha can be considered a spiritual place for value investors. It’s regarded by some as middle America, the center of the United States. It makes sense for Chinese visitors to want to visit this place, hear form its Oracle and breathe in some of its ethos.

During the meeting, several investors from China stepped to the microphone to ask about Buffett’s view on the impending trade war with China. Buffett told them he will be 88 this year, and since 8 is a lucky number in China, he should look for more acquisitions there. “The United States and China are going to be the two super powers of the world economically and in other ways over time,” Buffett said. “We have a lot of common interests and, like two big economic entities, there are times there will be tensions. It is a win-win situation when the world trades basically. And China and the U.S. are the two big factors in that.” Buffett walked through some trade statistics and made a case for globalism and free trade that some investors said sounded like it was from China’s central government playbook.

Charlie Munger piped in, explaining that both countries are advancing but China is advancing faster because it started from a low base and has a high savings rate. “A country that was mired in poverty for a long, long time and assimilates the advanced technology of the world and has a high savings? That country will advance faster than the UK or the U.S. I think we are getting along fine,” Munger said. “The last thing we need is for them to have woe for each other.”

Some Chinese in the audience smiled, clapped and cheered. Mr. Wei, the Chinese diplomat, smiled, clapped, patted his thigh and waved a thumbs up.

Buffett and Munger are not religious and, rather, exhibit skepticism toward organized religion. They believe in population control, pro-abortion policies. Buffett campaigned for Hillary Clinton and was close with Barack Obama. Their faith, if anything is in human potential, humanistic values and economic growth.

I am bullish on the future of the United States and bullish on China and the rest of the world. People are going to be living better.

In response to another question from a Chinese college student who asked about whether globalism will continue, Buffett gave an optimistic, globalist, free-trade answer. “There will be an invisible hand that does work to improve the lot of people in both countries and the world. It is much better to have people prospering throughout the world” through their own efforts and through being interconnected, Buffett explained. “I am bullish on the future of the United States and bullish on China and the rest of the world. People are going to be living better.”

Beyond the folksy banter and financial insight from Buffett and Munger, people came for networking with other investors at breakfasts, lunches, dinners, receptions and mini-investing conferences. They came to peruse the discounted products – from Justin cowboy boots to DairyQueen Dilly Bars and Borsheim’s jewelry -- from Berkshire owned companies.

Milling about the Berkshire exhibit hall, Linda Bi says she is girding up for a U.S. trade war with China. She is planning to adjust her business model to warehouse and distribution rather than importing. But she won’t lay off any of her 20 workers now (only four of them are Chinese), just as she didn’t during the Great Recession a decade ago.

“We saved the money for the rainy days,” she said. “I don’t have any plans to let people go. All my employees are very loyal. We spent good times together. We need to spend bad times together too.”